The Bipolar Economy Of 2023

Published Friday, February 3, 2023 at: 8:20 PM EST

Maybe it’s a sign of the times: The economy is bipolar. The new jobs numbers released Friday morning showed extraordinary strength in the job market and the index of leading economic indicators in January, released Thursday morning, experienced a decline for the eighth straight month, signaling a recession is coming in 2023.

Despite significant bad news in the form of yet another bad month for the LEI in January and experiencing a sharp decline of eight-tenths of 1%, the explosive number of new job figures for January make a recession unlikely.

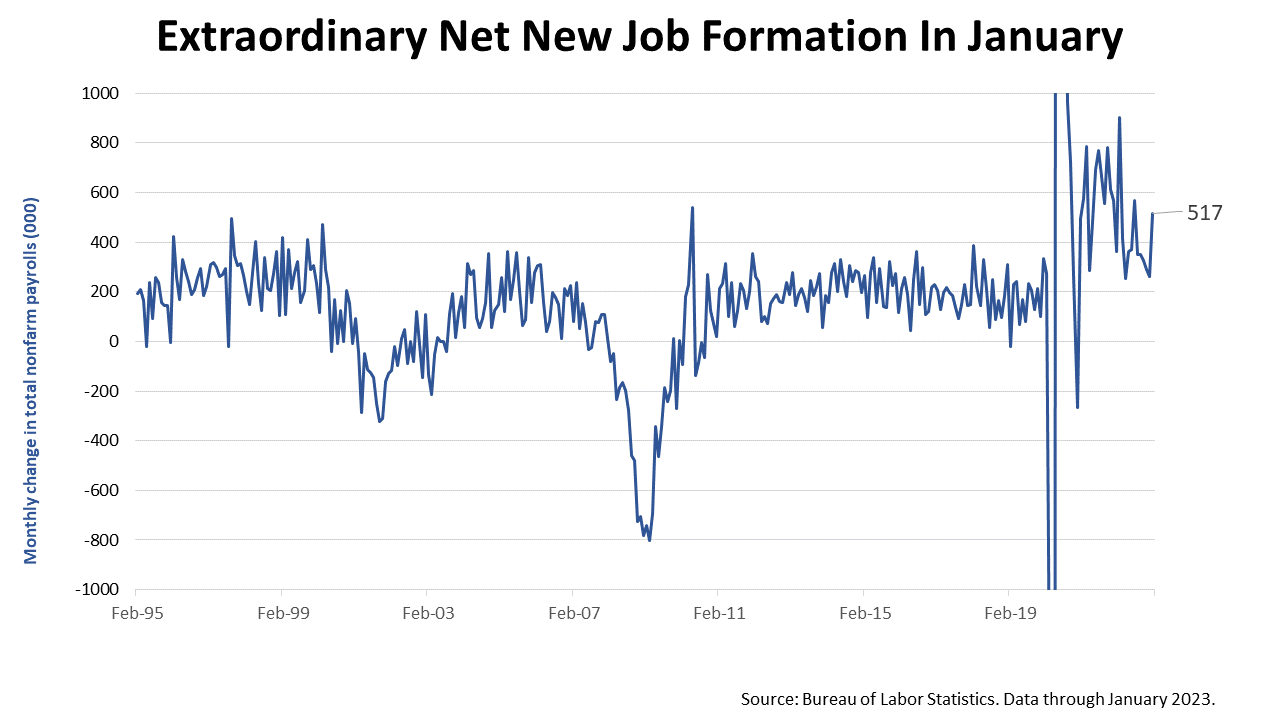

New job formation was expected to trend lower in January. Due to the aggressive monetary tightening implemented since March 2022 by the Federal Reserve, the economy was expected to create about 200,000 new jobs. Instead, job gains in January came in at 517,000 and the unemployment rate declined to the lowest level in decades.

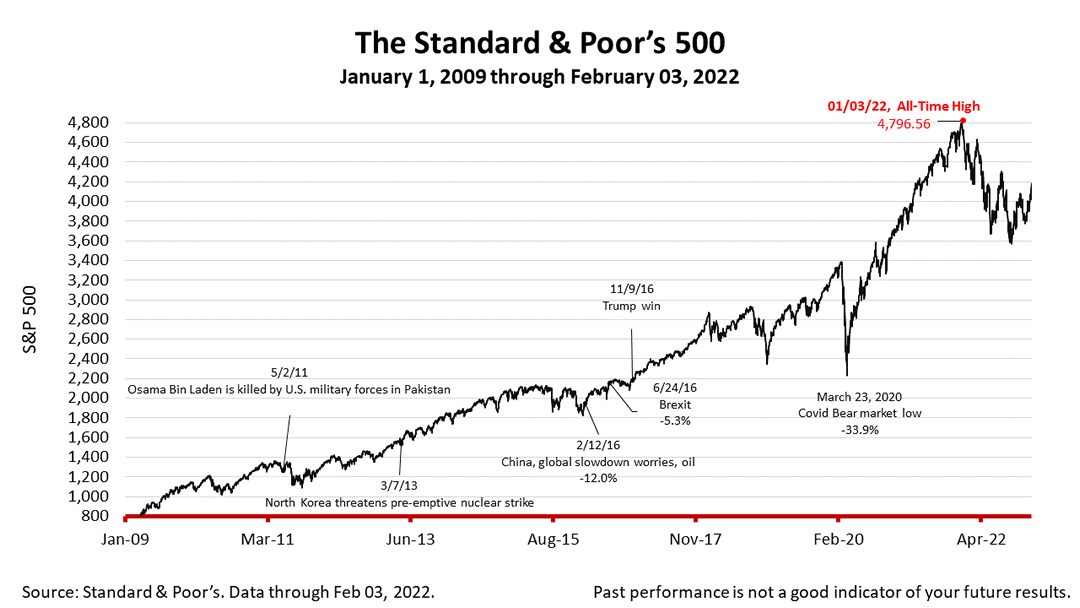

The Standard & Poor’s 500 stock index closed Friday at 4,136.48 down -1.04% from Thursday, and up +1.62% from a week ago. The index is up +84.88 from the March 23, 2020 Covid pandemic bear-market low. The S&P 500 remains in a bear market that began June 13, 2022. Since a low point at the end of October, stocks have cut their losses in half, closing the week -13.76% lower than its January 3, 2022, all-time high.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock's weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial advice without consulting a professional about your personal situation. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. Past performance is not an indicator of your future results.